In today’s digitally interconnected economy, understanding what is a watch list is no longer optional. Whether you operate in banking, insurance, telecom, fintech, or public services, your organization must understand the watchlist meaning, why individuals and entities get watchlisted, and how to implement watchlist screening solutions effectively. Watch lists are foundational tools in global compliance, fraud prevention, and anti-money laundering (AML) strategies.

In this article, we will explore the watch list definition, various types of watchlists (government, financial, sanctions), and how modern tools like Veridas empower organizations to meet compliance standards with AI-driven AML watchlist screening.

Watchlisted: What It Means and Why It Matters

To be watchlisted means that an individual, entity, or organization appears on a monitoring list maintained by a governmental body, financial authority, or global institution. Being watchlisted can result in heightened scrutiny, restricted transactions, or total denial of services.

Watchlists are typically linked to risks such as terrorism, organized crime, money laundering, sanctions evasion, and Politically Exposed Person (PEP) relationships. Financial institutions use these lists to identify and mitigate risk in onboarding and transactional operations.

Define Watchlist: Core Functions and Compliance Role

To define watchlist, it is a curated list containing names of individuals or organizations that require closer observation or risk assessment. These are not arbitrary lists—they are curated by institutions such as OFAC, the EU, UN, World Bank, and national regulators.

The purpose of a watchlist is two-fold: to protect financial systems from abuse and to ensure businesses avoid inadvertently engaging with high-risk entities. In the realm of customer screening AML, watchlists serve as the first line of defense against illicit activities.

Watchlist Meaning in Regulatory and Financial Contexts

The watchlist meaning extends beyond its dictionary definition. In financial services, a watch list for banks can dictate whether a customer is approved, escalated for enhanced due diligence, or rejected entirely.

For banks and other regulated entities, failing to screen effectively against a sanctions watchlist, AML watchlist, or PEP watchlists can lead to regulatory fines, reputational damage, and even criminal liability.

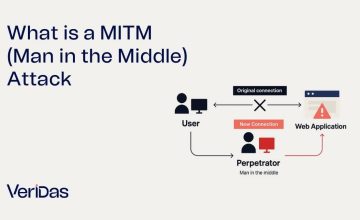

Risk Watch and the Evolution of Screening Technology

In the past, a “risk watch” process relied on static spreadsheets or outdated databases. Today, with real-time transactions, global commerce, and complex fraud networks, risk detection must evolve.

Veridas delivers AI-powered watchlist screening software that can process thousands of identities per second against global AML watchlist databases. This enables organizations to implement effective, scalable watchlist AML procedures.

Watch List Definition: Government, Financial, and AML Watchlists

The general watch list definition includes any official compilation of people or entities flagged for monitoring due to risks in security, finance, or criminal activity. There are several major categories:

- Government watchlists (e.g., Interpol, FBI, OFAC)

- Sanctions watchlists (e.g., UN, EU, UK HMT)

- PEP watchlists (politically exposed persons)

- Adverse media watchlists

- Finance watch list for credit, AML, and risk flags

Each list has distinct implications. A PEP listing may not block transactions but may trigger enhanced monitoring. A listing on a sanctions watchlist, however, usually leads to a legal prohibition.

Watch List Mean and Use Cases Across Industries

What does the watch list mean for various sectors?

- Banking watch list: Stops suspicious accounts or transactions

- Insurance: Flags claims from watchlisted policyholders

- Gaming: Blocks self-excluded or prohibited players

- Public sector: Tracks benefits abuse or criminal background

The meaning of a watch list expands with regulatory expectations. For AML, it means staying compliant with FATF recommendations, the EU AMLD, or FinCEN guidance.

Watch List Meaning in AML and KYC

In the context of anti-money laundering, the watch list meaning includes continuous risk assessment of customers. AML regulations demand that organizations run watchlist screening at onboarding and periodically throughout the customer lifecycle.

Modern tools like Veridas allow organizations to automate these checks. Through real-time access to thousands of AML watchlist databases, including ComplyAdvantage, Veridas provides proactive protection with minimal friction.

What is a Watch List? Global Use and Compliance Purpose

So, what is a watch list? In its simplest form, it is a tool to help institutions identify risky individuals and organizations before harm is done. In reality, it’s a complex compliance requirement that supports due diligence and risk scoring.

Whether it’s a banking watch list, a finance watch list, or a government watch list, these resources are indispensable for mitigating exposure and complying with AML laws.

What is the Watchlist in AI-Powered Customer Screening?

What is the watchlist in the context of customer screening? It’s a dynamic, ever-updated data source integrated into KYC processes through watchlist screening software.

Platforms like Veridas provide watchlist screening solutions that combine biometric verification, document validation, and AML checks in a unified workflow. This enables:

- Real-time flagging and escalation

- Biometric deduplication (1:N match)

- Integration with state registries and AML partners

- End-to-end AML watchlist screening for onboarding and ongoing KYC

Veridas enhances fraud prevention by ensuring identities are verified through biometric and document validation before being screened against thousands of watchlists, including politically exposed persons (PEPs), sanctions, and adverse media. This combination allows organizations to detect fraudulent or risky actors in real time, minimizing false positives and enhancing the accuracy of risk-based decision-making.

Whats a Watch List? Clarifying Terms and Technologies

Whats a watch list or whats a watchlist are common queries from businesses entering regulated markets. Here’s a quick recap:

- Watch list for banks: Screens accounts and transactions

- PEP watchlists: Detects high-profile political figures

- AML watchlist: Identifies money laundering suspects

- Sanctions watchlist: Flags illegal business partners

All these lists feed into a unified global watch list strategy enabled by Veridas, helping organizations scale compliance, reduce fraud, and automate decision-making.

Frequently Asked Questions (FAQs)

What is a watch list?

An official list of individuals or entities flagged for potential legal, financial, or reputational risk.

Define watchlist in finance

A watchlist in finance is used to monitor customers or partners for AML, fraud, or sanctions compliance purposes.

What does watchlisted mean?

It means an entity is listed on a government or financial watchlist due to perceived risk.

What is the watchlist used for?

To help financial institutions and businesses avoid engaging with high-risk individuals or companies.

What is a government watch list?

A registry maintained by a government agency for security, terrorism, or criminal tracking.

What is watchlist AML screening?

An automated check against sanctioned, politically exposed, or criminally linked individuals.